Filipinos suffering from cancer, hypertension, diabetes, kidney disease, mental illness, high cholesterol and tuberculosis will now have more medicines available to them at affordable prices with the latest approval by the Food and Drug Administration (FDA) of 20 new drugs exempted from the value added tax (VAT).

Senator Sonny Angara said there are now over 2,000 vat-exempt drugs for the prevention and management of specific ailments, which include some of the most prevalent among the population.

“Nagpapasalamat tayo sa paglabas ng panibangong listahan ng 20 na gamot para sa mga sakit tulad ng hypertension, diabetes, high cholesterol at kidney diseases na karaniwang nararanasan ng marami sa ating mga kababayan. Ito ang isa sa maraming benepisyo na naging bunga ng Republic Act 10963 o ang TRAIN (Tax Reform for Acceleration and Inclusion) Law,” said Angara who sponsored the tax reform measure.

This provision of the law was introduced by then Senator and now Finance Secretary Ralph Recto.

Before the passage of RA 10963, many Filipinos suffering from these common ailments tend to skip their medication because they could not afford it.

The exemption from VAT of the drugs that came as a result of the TRAIN and Corporate Recovery and Tax Incentives for Enterprises (CREATE) Laws has brought down their prices and made them more accessible to most Filipinos.

In FDA Advisory No. 2024-0329, the following medicines were added to the list of VAT-exempt health products:

For Cancer

• Sonidegib (as phosphate) 200 mg capsule;

• Pemetrexed (as disodium heptahydrate) 100 mg lyophilized powder for IV infusion;

• Asciminib (as hydrochloride) 20 mg tablet

• Asciminib (as hydrochloride) 40 mg tablet

• Palbociclib 75 mg tablet

• Palbociclib 100 mg tablet

• Palbociclib 125 mg tablet

• Pemetrexed (as disodium hemipentahydrate) 100 mg powder concentrate for solution for infusion

• Pemetrexed (as disodium hemipentahydrate) 10mg/ml solution for injection

• Cabasitaxel 60 mg/1.5 ml concentrate for solution for injection

• Entrectinib 100 mg

• Entrectinib 200 mg

For Hypertension

• Losartan Potassium+Amlodipine (as besilate) 100 mg/10 mg tablet

• Losartan Potassium+Amlodipine (as besilate) 100 mg/5 mg tablet

• Irbesartan+Amlodipine (as besilate) 300 mg/5 mg tablet

• Irbesartan+Amlodipine (as besilate) 300 mg/10 mg tablet

For Mental Illness

• Cariprazine (as hydrochloride) 1.5 mg capsule

• Cariprazine (as hydrochloride) 3 mg capsule

• Cariprazine (as hydrochloride) 4.5 mg capsule

• Cariprazine (as hydrochloride) 6 mg capsule

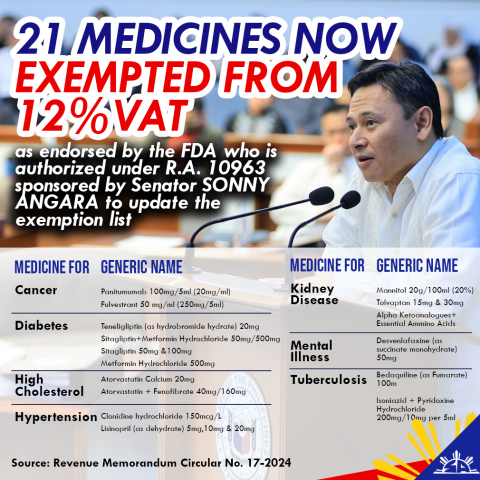

Last January, the Bureau of Internal Revenue also released a list of 21 medicines endorsed by the FDA for VAT exemption.

“The end goal of all of these actions is to make these lifesaving drugs more accessible to those who need it. This was the goal of the TRAIN and CREATE Laws when it included these provisions on VAT exemptions for select medicines. Taking care of one’s health should not be an option,” Angara said.

On top of the VAT exemption, Angara noted that senior citizens and persons with disabilities (PWDs) will still enjoy the discounts accorded to them under the law.

Angara is an author of RA 9994 or the Expanded Senior Citizen’s Act, which exempted from the VAT goods and services availed by seniors, as well as RA 10754 or the law that expanded the benefits granted to PWDs.

Apart from the VAT exemption on medicines, the TRAIN Law also reduced the income tax rates of the majority of wage earners and exempted those who earn P250,000 and below.